Abbott Pratt Tax Talks – How Long Should I Hold Onto My Tax Records For?

There is a long winded answer to this question, and there is a short one… we will provide the short but are always open for a discussion to expand upon our answer.

The short answer: In most cases a minimum of 3 years-we prefer 7. However, if you store them electronically, you’ll have them forever; and forever is always better!

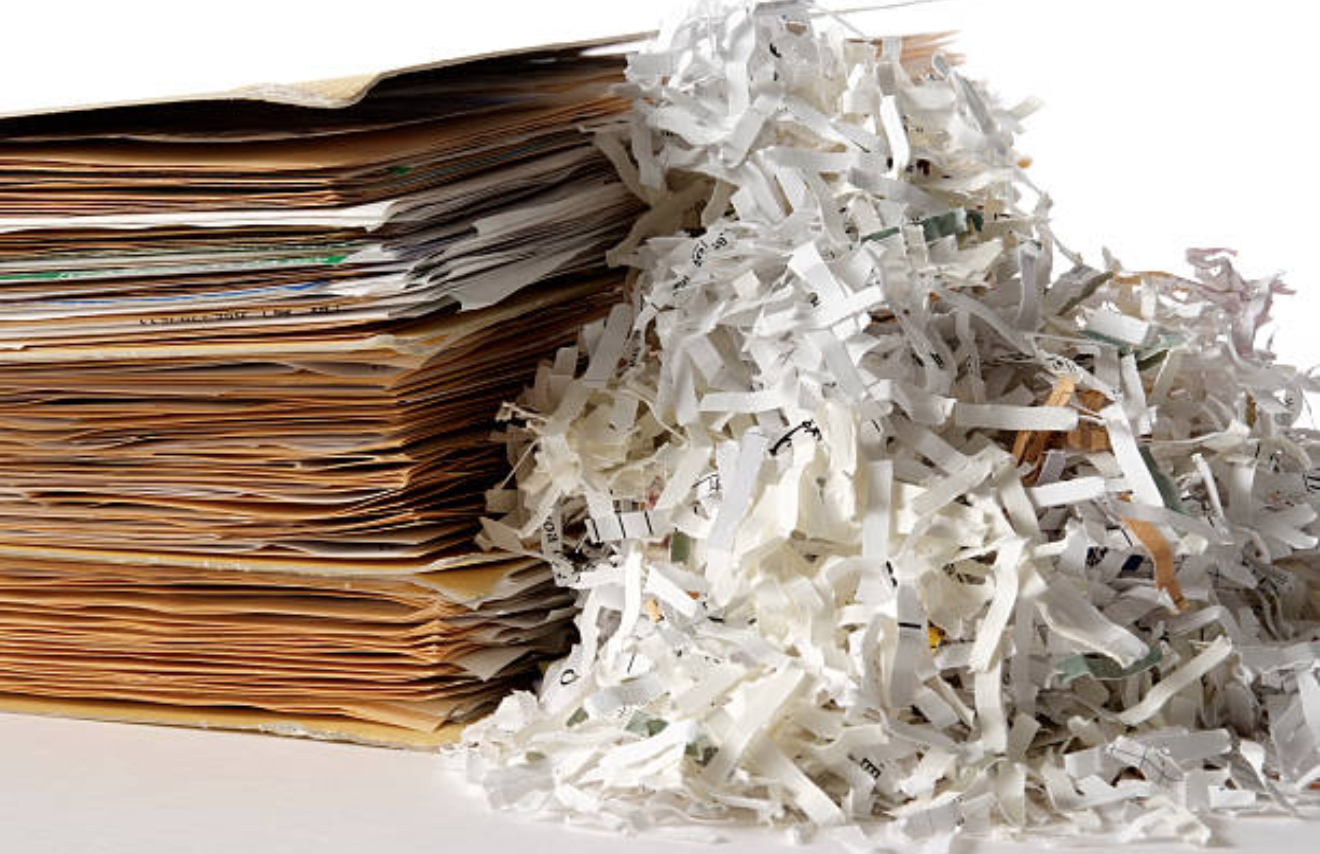

Like any tax situation, there are situations where 3 years would not be enough, even if the audit period has closed. It is always best to check before the papers head for the shredder.