Tips On Spotting Errors In Your Internal Financial Statements

Having worked closely with hundreds of veterinarian clients and business owners here at Granite Peak Associates, we make a point to provide high quality tailored services to allow you to

READ MORE

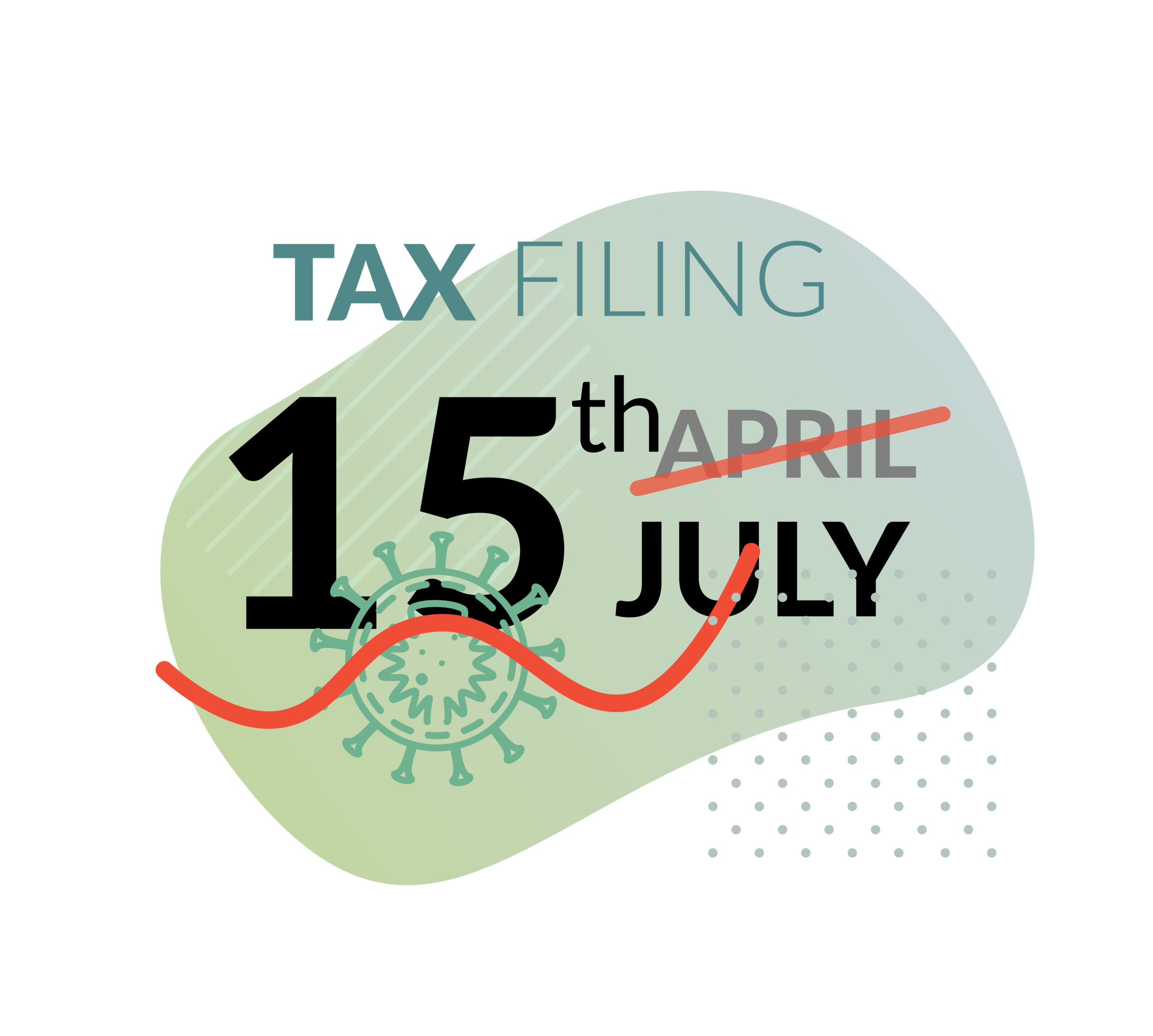

Individuals get Covid-19 income tax relief

Taxpayers now have more time to file their tax returns and pay any tax owed because of the coronavirus (COVID-19) pandemic. The Treasury Department and IRS announced that the federal

READ MORE

Accelerate Depreciation Deductions With a Cost Segregation Study

Is your business depreciating over a 30-year period the entire cost of constructing the building that houses your operation? If so, you should consider a cost segregation study. It may

READ MORE

Mark Your Calendars! Time to Get Ready for Your Small Business 1099-Misc Reporting

A month after the new year begins, your business may be required to comply with rules to report amounts paid to independent contractors, vendors and others. You may have to

READ MORE