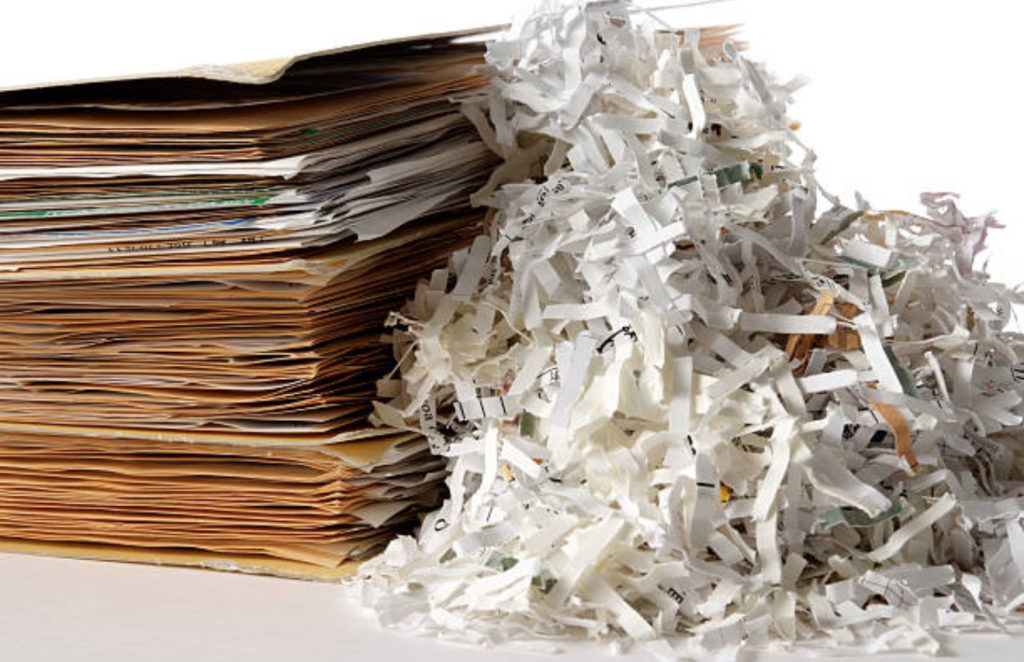

There is a long winded answer to this question, and there is a short one… we will provide the short but are always open for a discussion to expand upon our answer. The short answer: In most cases a minimum of 3 years-we prefer 7. However, if you store them electronically, you’ll have them forever; […]

Read More… from Abbott Pratt Tax Talks – How Long Should I Hold Onto My Tax Records For?